Open Editor’s Digest for free

Rula Khalaf, editor of the Financial Times, picks her favorite stories in this weekly newsletter.

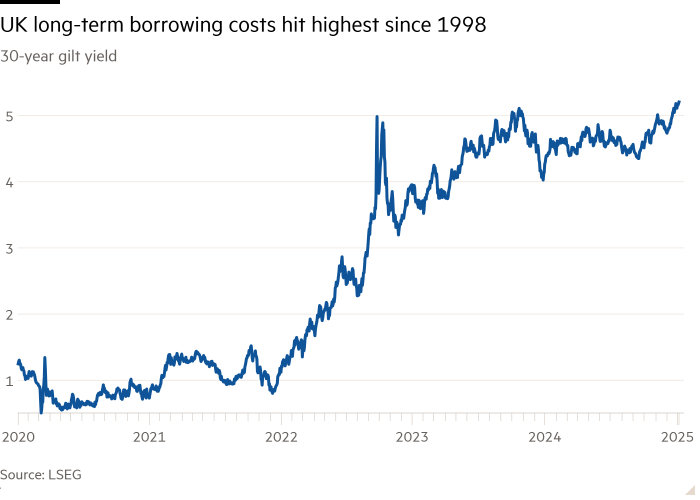

The UK’s long-term borrowing costs have reached their highest level since 1998 as investor concerns grow about the risk of stagflation.

The yield on 30-year government bonds reached 5.22 per cent on Tuesday, surpassing the previous peak reached in October 2023 and surpassing levels reached during the height of the market fallout from Liz Truss’s ill-fated “mini” Budget the previous year. .

The new high came after the Treasury paid the highest borrowing cost this century at a 30-year bond auction, selling £2.25 billion of new debt at a yield of 5.20 per cent.

Investor concerns about the outlook for the UK come amid a global sell-off in government bonds in recent months, driven in part by fears that US President-elect Donald Trump’s tariff plans will be inflationary.

But retirement investors were particularly concerned that a combination of weak growth and persistent price pressures would push the UK into a period of stagflation, with the Bank of England constrained from cutting interest rates to support the economy.

“There is likely to be a bit of a buyers strike at the moment,” said Craig Enches, head of cash and interest rates at Royal London Asset Management. He said a combination of the high volume of long-term government bond sales and “mixed” economic data in the UK was deterring investors from ultra-long-term debt.

Bond moves will be a concern at the Treasury, given that Chancellor Rachel Reeves left herself only a narrow margin of freedom against her revised fiscal rules when she set out borrowing plans in the October Budget.

The Treasury expects a new round of official forecasts from the Office for Budget Responsibility in March, which will include a new estimate of how much room for maneuver the government has against the self-imposed financial system.

Andrew Goodwin, of Oxford Economics, said he estimated that recent moves in yields and interest rate expectations had wiped out about two-thirds of the £9.9bn worth of availability against the chancellor’s main budget rule, which requires her to cover current spending – excluding investment – from tax revenues. . .

The final forecast for the rise will not be determined until a report closer to the OBR forecast is released.

“The Chancellor gambled a bit with the budget by leaving so little room,” Goodwin said. “There are many ways things can go wrong, and government bond yields were one obvious way.”

Adding to the pressure on the Chancellor is disappointing economic data, including stagnant growth figures. At its last meeting in December, the Bank of England forecast zero growth for the last quarter of 2024, following figures showing two consecutive months of slight contraction.

Business confidence has taken a hit in the wake of Reeves’ decision to impose a £25 billion increase on employers’ National Insurance contributions in the Budget, which along with planned increases in the National Living Wage will push up labor costs.

Meanwhile, investors have reduced their hopes for a rate cut in 2025 given continued signs of flat inflation. Consumer price growth accelerated in November to 2.6 percent from 2.3 percent in the previous month.

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F6131b6e1-121a-496f-a228-9ea989cd6ac2.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-01-07 11:12:00

#longterm #borrowing #costs #hit #highest #level